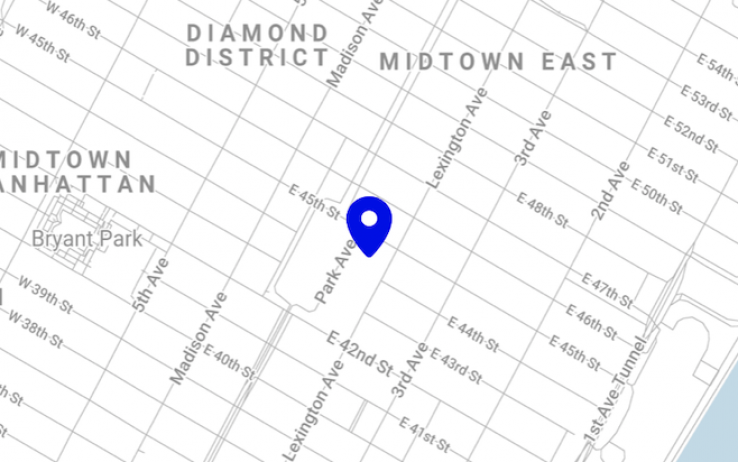

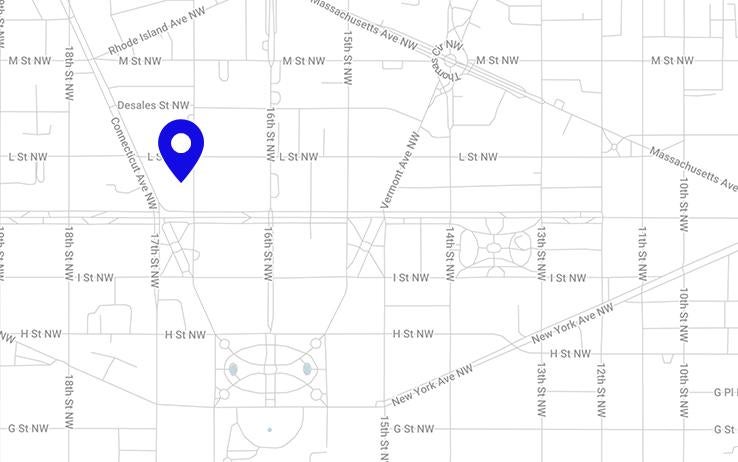

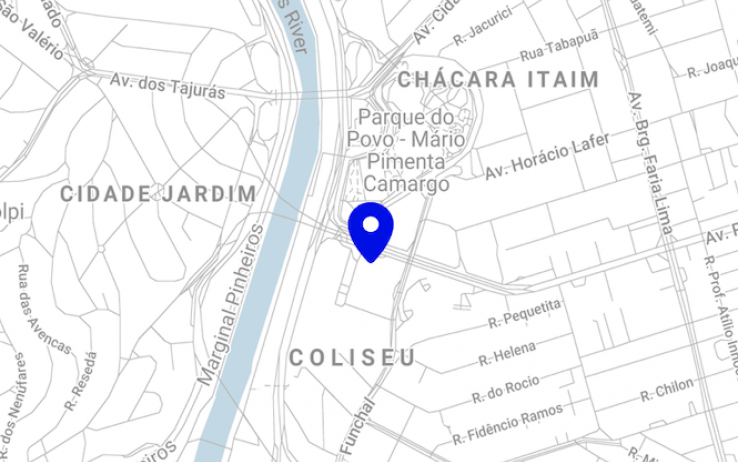

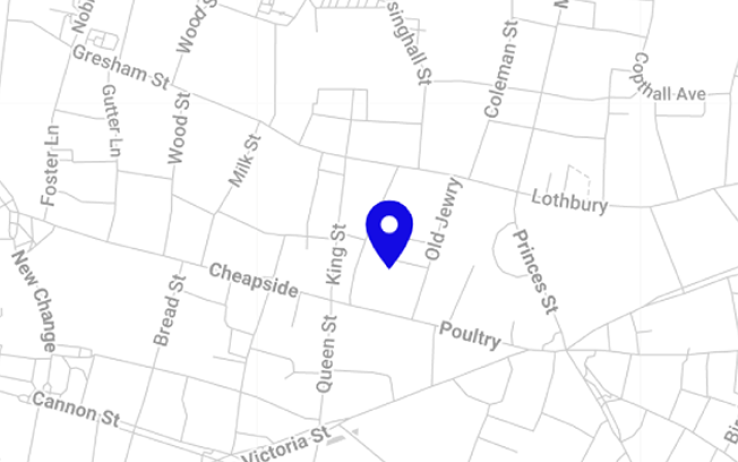

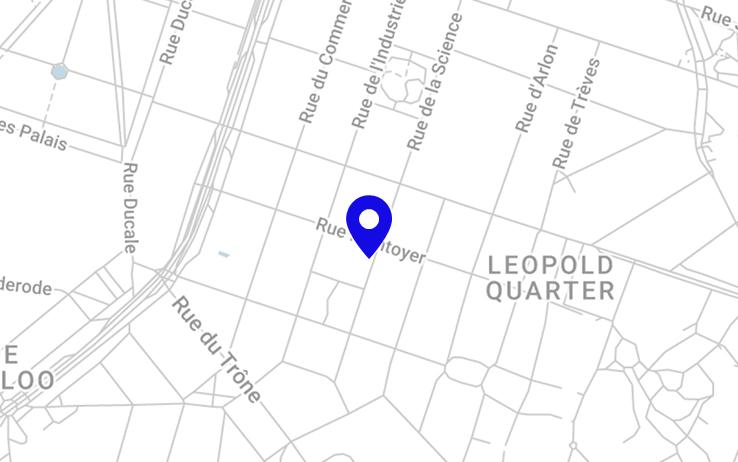

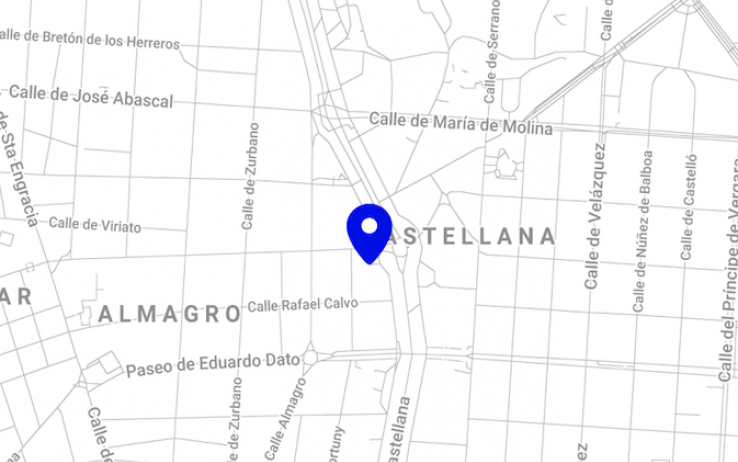

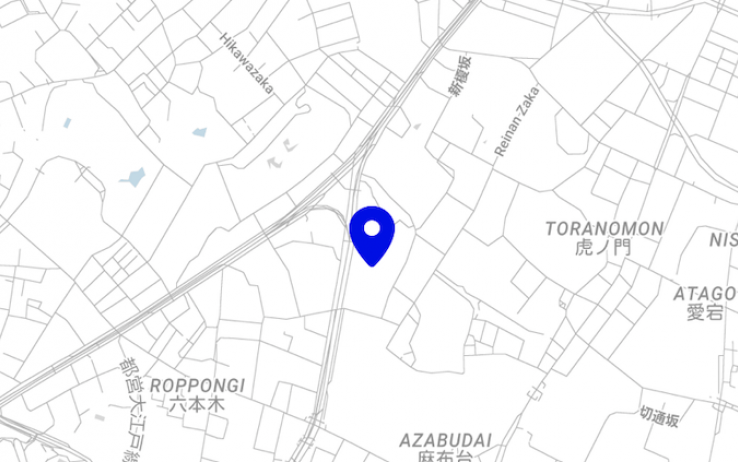

Offices

With offices strategically located in key business centers and political capitals, Davis Polk is a premier firm that leading companies and financial institutions around the world turn to for counsel on their most significant business and legal matters.