Federal Reserve Eases Daylight Overdraft Limits

The Federal Reserve has taken temporary measures (and has published FAQs) to (1) lift the net debit cap on and waive fees for daylight overdrafts for financially sound depository institutions, including U.S. branches and agencies of foreign banking organizations, and (2) provide a streamlined approval process for other depository institutions to incur collateralized daylight overdrafts, known as the max cap. These measures are designed to encourage the use of intraday credit provided by Federal Reserve banks and, in turn, “to support the provision of liquidity to households and businesses and the general smooth functioning of payment systems.” The temporary relief complements the Federal Reserve’s other actions to support the smooth flow of funds to U.S. households and businesses during the coronavirus crisis.

Absent the temporary relief, a depository institution with a Federal Reserve account must keep any daylight (or intraday) overdrafts within specified caps and must monitor its account and manage its transaction flows accordingly. The temporary relief is designed to “help institutions focus on other activities that support lending to households and businesses,” as well as to provide “a ready and flexible source of intraday funds to efficiently manage their liquidity risk.” A financially sound depository institution eligible for the lifted cap and waived fees on daylight overdrafts will not be expected to monitor or manage its Federal Reserve account balance throughout the day, provided that it extinguishes any daylight overdraft by the end of each Fedwire operating day (6:30 p.m.). Overnight credit is not subject to the temporary relief.

Absent further action from the Federal Reserve, the temporary relief will expire on September 30, 2020. During the period of the temporary relief, the Federal Reserve Banks will continue to monitor a depository institution’s condition, including its eligibility for primary credit as applicable, using financial and supervisory information in order to manage the Reserve Banks’ risk exposure.

In addition to the relief described above, the Federal Reserve has temporarily suspended two collections of information that it uses to calculate daylight overdraft caps. Depository institutions also need not formally renew their net debit caps, which they typically must do at least once every 12 months, while the temporary relief is in effect—though expiring net debit caps must be renewed once the temporary relief lapses.

Daylight Overdrafts and the PSR Policy

For those interested in more detail on daylight overdrafts under the Federal Reserve’s Payment System Risk Policy (the PSR Policy), we have provided additional information here, taken from the PSR Policy and an overview produced by the Federal Reserve.

The Federal Reserve Banks extend intraday credit, or daylight overdrafts, to financial institutions when an institution’s Federal Reserve account balance is insufficient to cover outgoing transactions, including Fedwire funds transfers, incoming Fedwire securities transfers, or other payment activity (e.g., checks or ACH transfers) processed by a Reserve Bank. The PSR Policy, among other things, establishes the Federal Reserve’s policy for limiting intraday credit extended to institutions to limit associated credit risk to the Reserve Banks while still providing sufficient intraday credit to ensure the smooth functioning of payment and settlement systems.

An institution with a Federal Reserve account may qualify for two types of intraday credit limits:

- Net Debit Cap. Each institution that incurs daylight overdrafts in its Federal Reserve account must adopt a net debit cap, which is a ceiling on the daylight overdraft position that it can incur during any given day.

- Cap Multiple. The net debit cap is defined as the product of a cap multiple times the institution’s capital measure.

- The capital measure used in the net debit cap formula depends on the entity – e.g., for a U.S.-chartered institution, the capital instruments used to satisfy its applicable risk-based capital standards.

- An institution that has regular access to the discount window, is in healthy financial condition and incurs daylight overdrafts up to the lesser of $10 million or 20 percent its capital is exempt from adopting a cap multiple and is automatically eligible to continue incurring overdrafts under the threshold.

- Other institutions must select one of several pre-defined cap multiples between zero and 2.25, with greater cap multiples requiring heightened eligibility criteria, including more thorough self-assessments and reviews by the institution’s board of directors.

- An institution must be financially healthy and have regular access to the discount window in order to adopt a net debit cap greater than zero.

- An institution may voluntarily select a zero net debit cap or be assigned a zero cap based on its Reserve Bank’s assessment of its risk.

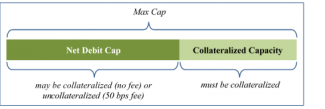

- Optional Collateralization and Fees. Daylight overdrafts up to the net debit cap may be uncollateralized or collateralized.

- The Federal Reserve incentivizes collateralization by charging a fee for uncollateralized overdrafts of 50 bps – applied to the average minute-by-minute uncollateralized daylight overdraft, adjusted to the 21.5-hour Fedwire operating day (from 9:00 p.m. ET the day before to 6:30 p.m. ET) and a 360-day year.

- Collateralized daylight overdrafts incur no fee.

- Pledged collateral is subject to valuation and margining by its Reserve Bank.

- Max Cap. In addition, an institution with a self-assessed net debit cap may receive approval to pledge additional collateral to its Reserve Bank to secure daylight overdraft capacity in excess of its net debit cap.

- In considering an institution’s request for additional collateralized capacity, the Reserve Bank evaluates the institution’s rationale for requesting additional daylight overdraft capacity, its capital and liquidity ratios, the composition of its balance sheet assets and its CAMELS or other supervisory ratings and assessments.

- The institution’s max cap is equal to its net debit cap plus the additional approved collateralized capacity.

- As with collateralized daylight overdrafts under the net debit cap, collateral pledged by an institution up to the max cap is subject to valuation and margining by its Reserve Bank.

- Cap Multiple. The net debit cap is defined as the product of a cap multiple times the institution’s capital measure.