U.S. Banking Agencies Propose Custody Bank Relief under the Supplementary Leverage Ratio

The U.S. banking agencies have proposed allowing custodial banking organizations to exclude certain central bank deposits from the calculation of total leverage exposure, the denominator of the U.S. Basel III supplementary leverage ratio (SLR). The proposal implements Section 402 of the Economic Growth, Regulatory Relief and Consumer Protection Act of 2018 (EGRRCPA). The three U.S. banking organizations that would benefit from this proposal are BNY Mellon, Northern Trust and State Street.

Scope of Relief

The SLR is the ratio of an advanced approaches banking organization’s tier 1 capital over its total leverage exposure – a non-risk weighted measure of the firm’s assets and off-balance sheet exposures that is meant to serve as a backstop for risk-weighted ratios. Deposits held by a banking organization with another bank, including a central bank, are on-balance sheet assets. As a result, a banking organization’s central bank deposits increase its total leverage exposure, which in turn increases the tier 1 capital that must be held to meet the banking organization’s SLR requirements.

Prior to EGRRCPA, commenters had generally argued for the exclusion of central bank deposits from total leverage exposure, in part to recognize the lack of risk associated with central bank deposits compared to other assets and in part to recognize that the amount of central bank deposits is also a function of client-driven activity. Custody banks, in particular, argued that the inclusion of central bank deposits disproportionately affected them because their business model requires them to maintain a greater amount of central bank deposits than other firms.

Clients of custody banks that maintain fiduciary or custodial and safekeeping accounts (FCS Accounts) for securities at a custody bank typically also maintain cash deposit accounts at the custody bank. These deposit accounts are used to fund investments or to settle or otherwise facilitate transactions executed in the clients’ FCS Accounts. The balances in these deposit accounts may fluctuate significantly within a day or day-to-day, potentially resulting in large outflows (or inflows) if a client funds a large investment or settles a high volume of transactions at once. To manage these fluctuations, a custody bank may, in turn, hold a material portion of its client’s deposit account balances on deposit at central banks, providing liquidity to cover expected outflows. In stressed conditions, a client’s deposit account balances may grow if, for example, the client liquidates securities in its FCS Accounts – leading the custody bank to hold even greater balances on deposit at central banks.

Section 402 of EGRRCPA instructed the U.S. banking agencies to adopt a rule permitting custodial banking organizations to exclude from the total leverage exposure denominator of the SLR the amount of an organization’s qualifying central bank deposits up to the aggregate balance of its clients’ deposit accounts that are “linked to” FCS Accounts.

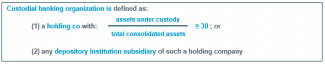

Definition of “Custodial Banking Organization”

The proposed SLR relief would only apply to “custodial banking organizations,” which the rule would define to mean any depository institution holding company that had an average ratio of assets under custody (AUC) to total consolidated assets, for the four most recent quarters, of at least 30 to 1, as well as any insured or uninsured depository institution subsidiary of such a holding company.[1] A banking organization’s AUC would be as reported on its Form FR Y-15, while total consolidated assets would be as reported on its Form FR Y-9C.

The agencies chose the 30-to-1 ratio as approximately the midpoint between the minimum ratio observed for BNY Mellon, Northern Trust and State Street (52 to 1) and the maximum ratio observed for all other advanced approaches banking organizations (9 to 1) over the period from Q2 2016 to Q3 2018. The threshold is also slightly lower than the minimum ratio observed for BNY Mellon, Northern Trust and State Street between Q1 2004 and Q3 2018.

As the proposed rule is currently drafted, a custodial banking organization that ceases to meet or exceed the minimum 30-to-1 ratio over the four most recent quarters would immediately cease to qualify for the relief and would immediately become subject to a higher total leverage exposure measure. The agencies requested comment on whether a longer delay for the loss of an organization’s status as a custodial banking organization would be appropriate in stressed conditions.

Mechanics of Relief

The proposal would establish a deduction for central bank deposits from a custodial banking organization’s total leverage exposure equal to the lesser of:

- the total amount of funds the firm and its consolidated subsidiaries (including foreign subsidiaries[2]) have on deposit at qualifying central banks;[3] and

- the total amount of client funds on deposit at the custodial banking organization that are linked to FCS accounts.[4]

A “qualifying central bank” would mean a Federal Reserve Bank, the European Central Bank, and the central bank of any OECD country if (i) the sovereign exposures of the country receive a 0% risk weight under the U.S. Basel III capital rules and (ii) the sovereign debt of the country is not in default and has not been in default during the previous five years.

A deposit account would be “linked to” an FCS Account if (i) the deposit account is provided to a client that maintains an FCS Account with the firm and (ii) the deposit account is used to facilitate the administration of the FCS Account – e.g., if the deposit account holds interest and dividend payments related to or funds the purchase and sale of securities in the FCS Account.

Relationship to Other Requirements

As proposed, for custodial banking organizations that are GSIBs (i.e., BNY Mellon and State Street) and therefore are subject to the Federal Reserve’s total loss-absorbing capacity (TLAC) and long-term debt (LTD) requirements, the exclusion from total leverage exposure for the SLR would also affect the firm’s total leverage exposure for the purposes of calculating its leverage-based external TLAC and eligible LTD ratios because the definition of total leverage exposure under the TLAC rule is the same as under the U.S. Basel III capital rules. The agencies have requested comment on the advantages and disadvantages of this approach versus allowing the total leverage exposure exclusion to apply only to custodial banking organizations’ SLR calculations.

The proposed rule would not alter other leverage calculations, including the tier 1 leverage ratio or total leverage exposure amounts as reported on the FR Y-15, which is used to identify GSIBs and determine firms’ GSIB surcharge amounts.

It remains to be seen how the U.S. banking agencies will reconcile the proposed SLR relief for custodial banking organizations with the earlier proposed recalibration of the enhanced supplementary leverage ratio (eSLR) requirements applicable to U.S. GSIBs and their insured depository institution subsidiaries (see an earlier post on the proposed eSLR relief here). In testimony before the U.S. Senate Committee on Banking, Housing and Urban Affairs last year, Federal Reserve Vice Chairman for Supervision Randal K. Quarles stated that the agencies may consider adjusting the calibration of relief under the proposed eSLR rule and the exclusion from total leverage exposure for custodial banking organizations under what was then the bill that became EGRRCPA in order to avoid “double counting” of relief.

Law Clerk Carol Rodrigues contributed to this post

[1] A subsidiary depository institution of a custodial banking organization would not be required separately to meet the 30-to-1 ratio of AUC to total consolidated assets. The proposed relief would not apply to stand-alone depository institutions – i.e., depository institutions not controlled by a holding company – that would otherwise satisfy the 30-to-1 ratio of AUC to total consolidated assets, but the agencies are considering extending the relief to such institutions.

[2] A foreign subsidiary’s central bank deposits would be converted to U.S. dollars for purposes of the calculation.

[3] According to the preamble to the proposed rule, the total qualifying central bank deposit amount would be calculated as the average daily balance over the reporting quarter to align with the calculation of the on-balance sheet assets component of total leverage exposure based on an average daily balance. We note that the text of the proposed rule does not make this clear.

[4] The agencies do not expect that the scope of FCS accounts as defined under the rule would deviate materially from the current scope of FCS accounts reported under Schedule RC-T of an insured depository institution’s Call Report.